Sell Your Gold Coins at DEIGOLDANDSILVERCOINS with Free Verbal Appraisal

Buying gold coins online can feel complex. Choosing the right dealer is one of the most consequential investment decisions you’ll make. We’ve fulfilled millions of orders, representing over $10 billion in precious metals delivered to clients nationwide.

Performance metrics tell only part of the story. With verified customer feedback and an average rating of 4.9 out of 5 stars, our commitment extends beyond transactions—we focus on long-term client confidence. Ninety-seven percent of clients rate their experience five stars for service and product quality.

At DEIGOLDANDSILVERCOINS, the value of purchasing gold coins extends beyond scale and experience. We’re recognized for a streamlined, secure, and transparent buying experience. Below, explore the primary categories of gold coins to consider for your portfolio.

Gold Coin Sizes and Weights We Offer

Gold coins don’t come in one size fits all. Whether you’re starting small or going big, we’ve got a variety of options to match your budget and investment goals:

- 1 oz (standard size for most gold bullion investors)

- 1/2 oz

- 1/4 oz

- 1/10 oz

- 1/20 oz

- 1/25 oz

- 1/50 oz

- Gram-based weights from 1/2 gram up to 1 kilogram

Fractional gold coins are issued by multiple government and sovereign mints, allowing investors to allocate holdings with greater flexibility and enter the market in smaller increments. In recent years, gram-based weight standards have expanded global availability, supporting both collectible demand and practical portfolio diversification.

Top Gold Coins for Sale

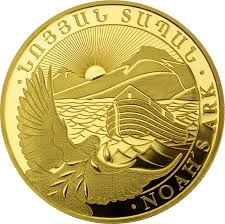

Some gold coins tend to be more sought-after than others. This popularity often stems from factors like purity, design, or the prestige of the mint behind them. Below are some of the gold coins that attract the most investor interest:

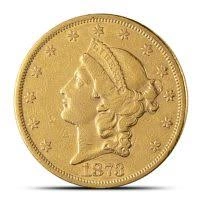

The first U.S. bullion coin, made of 22-karat gold (91.67% pure), features Augustus Saint-Gaudens’ Liberty design. Available in four sizes: 1 oz, 1/2 oz, 1/4 oz, and 1/10 oz, it’s popular among American investors.

Introduced in 1979, this coin became famous in 1982 for its .9999 purity. Minted by the Royal Canadian Mint, it’s available in 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, 1/20 oz, and 1 gram sizes.

The second U.S. gold coin is the purest (.9999) issued by the U.S. Mint. Inspired by the iconic Buffalo Nickel, it’s only available in a 1 oz size, except for limited 2008 fractional mintage releases.

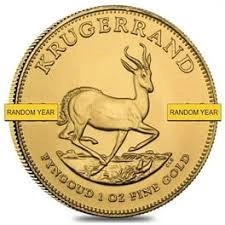

Launched in 1967, the Krugerrand is the world’s first modern bullion coin. Struck in 22-karat gold, it helped create the private gold market. It’s available in 1 oz, 1/2 oz, 1/4 oz, and 1/10 oz sizes.

Known for its elegant design featuring musical instruments, this .9999 fine gold coin is Austria’s most famous bullion piece. Offered in 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, and a rare 1/25 oz size.

Minted in .9999 fine gold, this coin features a new kangaroo design annually. It offers a wide range of sizes, including 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, 1/20 oz, plus larger 2 oz and 1 kilo versions.

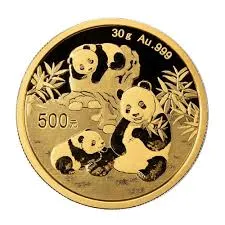

Part of the Lunar Series celebrating the Chinese zodiac, this .9999 gold coin features annually changing designs. It’s highly collectible and available in five sizes: 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, and 1/20 oz.

Modern & Vintage Gold Coins

While purchasing individual gold bullion coins is a perfectly valid strategy, many collectors enjoy assembling complete sets, acquiring pre-1933 gold coins, or building themed gold coin collections. As mentioned earlier, examples include the Australian Lunar series and the Bavarian Mint’s African Wildlife collection.

Other sought-after collections among investors include China’s Gold Pandas and Austria’s Gold Philharmonics. In some series, the coins may vary greatly in design over the years. In others, collectors aim for one coin from every year of production to form a complete set.

These types of collections often attract investors who appreciate visual appeal and organized displays. Many sets are available directly from official mints, and a full collection can be an impressive addition to any portfolio or showcase.

Another reason investors may lean toward sets is value. Surprisingly, full collections are often priced with lower premiums compared to buying the coins individually, making them a cost-effective method to increase gold holdings without overpaying.

Regardless of which gold coins you choose to invest in, always keep an eye on the current spot price of gold. This market rate determines the base value and premium for every gold coin, so understanding price trends is essential before making any purchase.

We’re Actively Buying Gold Coins

It may seem like a simple question, but the answer is not universal. The most suitable gold coins depend on your investment objectives and how they align with your broader portfolio strategy.

While the core goal is long-term value appreciation—and there is no such thing as “bad” gold from a valuation standpoint—your specific risk profile, liquidity needs, and time horizon will determine which options best serve your objectives.

Here are a few essential factors to keep in mind when building your gold portfolio:

- Liquidity: Consider how easy it will be to resell or buy a particular coin. Coins with high demand and recognition typically offer better liquidity.

- Purity: Coins with higher purity, such as .999 or .9999 fine gold, are usually favored over alloyed coins when investing in gold for weight and value.

- Mass: Focus on maximizing the total gold content in your holdings. Some investors prioritize total gold weight rather than specific series or collectible coins.

- Affordability: Pay attention to premiums. Some coins, especially in smaller weights, carry higher premiums than others, which affects the overall value of your investment.

It’s important to clarify that true gold coins are issued by official government mints and recognized as legal tender. While gold rounds may look similar, they are produced by private mints and aren’t classified as currency, valued only for their gold content and artistic design.

Popular gold coins among investors include the American Gold Eagle, American Gold Buffalo, Canadian Maple Leaf, and Gold Britannia. Still, more than a dozen sovereign nations mint their bullion coins, and some collectors also include historical or circulated coins as part of a well-rounded portfolio.

Is It Safe to Buy Gold Coins Online?

Absolutely. With DEIGOLDANDSILVERCOINS, you get a safe, secure, and fully insured transaction process. Our reputation, volume, and customer satisfaction prove it.

We’re here 24/7 to help guide your investment. No matter if you’re just getting started or looking to expand your collection, our dedicated experts are only a message or a call away.

Our Customer Reviews

With a 4.9-star rating, our customers consistently praise our reliability, fast shipping, and quality products. See why investors continue to trust DEIGOLDANDSILVERCOINS through the experiences and success stories they’ve shared.

FAQ's

One ounce of gold is valued according to the live global gold spot price. This price changes throughout the day based on market demand, inflation trends, and economic conditions, making gold prices dynamic and time-sensitive.

You can usually sell one ounce of gold close to the current spot price. The final amount depends on market demand, coin condition, and dealer margins, but gold coins generally retain strong resale value.

Most banks in the US no longer sell gold coins to the public. Banking institutions focus on financial services rather than physical precious metals, which are now mainly sold through professional bullion and coin dealers.

Banks stopped accepting gold coins due to regulatory changes, storage risks, and verification challenges. Handling physical gold requires specialized processes, so banks shifted away from precious metals toward digital and paper-based assets.

Gold prices may rise significantly over time due to inflation, currency devaluation, and global uncertainty. While reaching $5,000 per ounce is possible, future prices depend on economic conditions and investor demand.

Gold ownership was restricted in 1933 to stabilize the economy during the Great Depression. The government aimed to control gold reserves and monetary supply, leading to temporary limits on private gold ownership.

Yes, owning pre-1933 gold coins is legal in the United States. These coins are considered collectible and exempt from historical gold ownership restrictions, making them widely traded among investors and collectors.

There is no legal limit on how much gold a US citizen can own. Individuals are free to buy, hold, and sell gold coins and bullion as part of personal investment or wealth-preservation strategies.

Gold coins are often viewed as a safe-haven investment during economic uncertainty. They help preserve value, hedge against inflation, and diversify portfolios, especially when traditional financial markets become volatile.

A gold coin’s value depends on gold content, current market price, rarity, condition, and demand. Coins with higher purity or collectible appeal may carry premiums beyond their basic gold value.

Buy or Sell Gold & Silver Coins with Confidence

Work with a trusted Las Vegas coin dealer offering fair pricing, honest appraisals, and expert guidance every step of the way.