1/4 Gram Horseshoe Gold Round

1/2 Gram Monarch Clover Gold Round

1 Gram Gold Round (Varied)

1 gram Monarch Cliper Ship Gold

1/25 oz Holy Land Mint Gold Round

1/4 oz GOld Round (Varied Condtion)

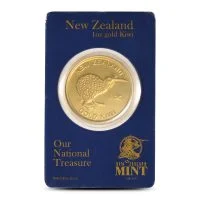

1 oz NewZeeland Gold kiwi Round

1 oz Gold Round Varied condtion

1 oz PAC-MAN Game Token

1/200 OZ Egypt Scarab Gold round

1/4 Gold Round Varied Condition

5 gram Gold Round Varied Condition

1/2 OZ Gold Round (Varied Condition)

2025 1 oz texas mint state capitol Gold

Start Selling Gold Rounds Securely with DEIGOLDANDSILVERCOINS

When it comes to buying gold from DEIGOLDANDSILVERCOINS, your attention likely starts with purchasing gold coins and gold bullion bars. These remain the top choice for many investors. Coins, in particular, are often preferred because they feature limited mintages, distinctive designs, and are sometimes available only for a short period. Still, there’s another option for both investors and collectors: gold rounds. Take a moment to learn more about gold rounds today!

What is a Gold Round?

A gold round looks very similar to a coin, but it is not issued as legal tender. In the United States, coins can only be produced by the US Mint under congressional authority, and those carry a legal face value. Since private mints cannot strike coins with government backing, they produce “gold rounds” instead.

Gold rounds still carry many of the same hallmarks as coins: they are circular, feature flat surfaces, and often display intricate designs on both the obverse and reverse. The key difference is the lack of a government-issued denomination.

Selling Gold Rounds

Gold rounds appeal to both collectors and investors, and they hold solid secondary-market value. Many rounds highlight simple mint logos and purity marks, showcasing their .999 or .9999 fine gold. Others replicate historic coinage designs, making them popular among sellers who originally purchased them as affordable alternatives to higher-premium collectible coins.

Some of the most recognized designs include recreations of classics such as the Buffalo Nickel or the Liberty design by Augustus Saint-Gaudens. While the coins featuring these designs often carry higher premiums, gold rounds provide the same visual appeal without the additional costs at the time of purchase, making them easier to resell today.

Rounds Compared to Coins and Bars

The main separation between coins and rounds lies in the issuing authority and legal tender status. Coins come only from official mints like the US Mint, while rounds are produced by private mints such as Golden State Mint. Bars and rounds often trade at similar premiums over spot price, with both serving as accessible bullion products. Bars, however, are issued in a wider variety of sizes, while rounds tend to be offered in more standard weights.

From a resale perspective, both gold bars and rounds are straightforward to liquidate. The value is based on weight, purity, and current market pricing. Collectible designs may also add appeal to certain buyers, further supporting their resale strength.

Market Demand for Gold Rounds

Because they are produced by private mints worldwide, gold rounds are often available without strict mintage caps. This allows for a wide variety of designs to circulate in the marketplace, from simple branded bullion pieces to rounds featuring historic and artistic motifs. The steady demand makes them a practical and valuable item to sell when you’re looking to cash in your collection.

Sell Your Gold Rounds to DEIGOLDANDSILVERCOINS

At DEIGOLDANDSILVERCOINS, we make the process of selling your gold rounds secure, transparent, and rewarding. Our team evaluates each round carefully based on weight, purity, and current market value to ensure you receive a fair and accurate offer. If you’re ready to sell, reach out to our specialists today. You can call us directly or email our team for a quick, friendly response.

FAQ's

Gold rounds are privately minted bullion pieces made from pure gold, usually .999 or higher. They are valued by weight and gold content, not face value, making them a cost-effective choice for investors seeking physical gold ownership.

Gold rounds are not legal tender and are produced by private mints, while gold coins are government-issued with face value. Rounds usually have lower premiums, making them popular among investors focused on gold weight rather than collectibility.

Yes, gold rounds are ideal for beginners because they offer pure gold at lower premiums than coins. They are easy to buy, sell, and store, making them a simple and affordable entry point into physical gold investing.

You can buy gold rounds safely from reputable bullion dealers like deigoldandsilvercoins.com. Trusted dealers provide secure checkout, insured shipping, transparent pricing, and authenticity guarantees, ensuring a safe and reliable online gold-buying experience.

Gold rounds are priced close to the spot price of gold, plus a small premium. Premiums vary by brand, size, and market demand but are usually lower than gold coins, making rounds a budget-friendly bullion option.

Well-known gold round brands include Sunshine Mint, Scottsdale Mint, Asahi Refining, and Silvertowne. These brands are trusted for consistent purity, precise weight, and strong recognition among bullion dealers and investors worldwide.

Genuine gold rounds have precise weight, correct dimensions, and verified purity markings. Buying from trusted dealers, checking certifications, and using professional testing methods like XRF or magnet tests help ensure authenticity and avoid counterfeit gold.

Yes, gold rounds are highly liquid and can be sold back to major bullion dealers at current market prices. Reputable dealers regularly buy gold rounds based on spot price, making them easy to convert into cash when needed.

Gold rounds help diversify investment portfolios by adding a tangible asset that often moves independently of stocks and bonds. They are commonly used as a hedge against inflation, currency risk, and economic uncertainty.

There is no legal limit on how much gold a US citizen can own. Investors can freely buy, hold, and sell gold rounds, making them a flexible and unrestricted way to invest in physical gold.

Buy or Sell Gold & Silver Coins with Confidence

Work with a trusted Las Vegas coin dealer offering fair pricing, honest appraisals, and expert guidance every step of the way.