1/10 oz Monarch Egyptian Nefertiti Silver Round

UnCirculated 1/10 oz Gold Coin

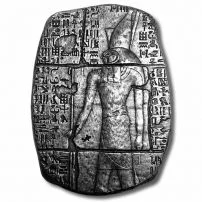

1/4 oz Monarch Egyptian Silver Bar

1/4 oz Monarch Egyptian Relic Silver Bar

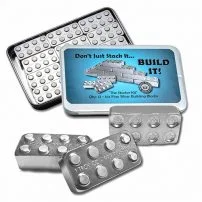

1/4 oz Monarch Building Block Silver Bar

1.5 oz MK Bars Hand Poured Witch Hat

1 oz MK Bars Holy Cross Shield

1.25 oz MK Bars Hand Poured Burial Flag

1 oz MK Bars Four Leaf Clover Shaped Silver

2 oz Monarch Hand poured Silver Bar

2 oz MK Bars 9mm Hand Gun Poured Silver Bar

1.25 oz MK Bars Hand Poured Burial Flag

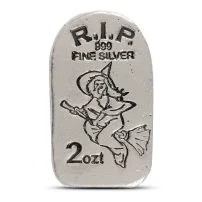

2 oz Monarch tombstone witches silver bar

2 oz Monarch tombstone Mummy silver bar

2 oz Monarch tombstone Vampire silver bar

1.25 oz MK Bars Hand Poured Burial Flag

2.5 oz Monarch hand poured skeleton

3 oz Monarch hand poured USA shield

3 oz Monarch hand poured silver bar

1.25 oz MK Bars Hand Poured Burial Flag

10 oz Engelherd poured Silver bar

100 oz Engelherd poured Gold Standered Silver bar

100 oz Engelherd cast poured Silver bar

1 oz Monarch Buidling block silver Bar Starter Kit

Poured Silver Bullion Bars

The promise of silver’s return on investment (ROI) has captivated market-savvy investors for decades. The bullion market has seen its share of ups and downs, and people are curious about the benefits of selling their silver bullion, particularly poured silver bars, to trusted buyers like DEIGOLDANDSILVERCOINS.

Silver is available in several forms, but poured silver bars remain a popular choice among investors looking to liquidate assets. The precious metal is melted and purified at extreme heat in a crucible, then poured into a mold of predetermined size and weight. The bars are typically sold in 1 oz, 5 oz, 10 oz, and 100 oz increments.

Note: Precious metals are measured in troy ounces as opposed to avoirdupois ounces. There are 16 avoirdupois ounces in a pound, but only 12 troy ounces in a troy pound.

How Market Conditions Influence Selling Decisions

Market conditions play an important role in determining when sellers choose to liquidate physical silver holdings. Economic uncertainty, inflation concerns, and shifts in industrial demand can all influence pricing trends.

Many sellers monitor spot pricing and choose to sell during upward movements or periods of increased volatility. Others liquidate assets for portfolio rebalancing, estate planning, or cash flow needs.

Understanding current market dynamics helps sellers make informed decisions and set realistic expectations when entering the selling process.

Who Makes Silver Bars?

Anyone can create their bullion at home, but the process is time-consuming and dangerous. If you want to sell poured silver bars, the best approach is to work with bars manufactured by reputable mints. DEIGOLDANDSILVERCOINS purchases bullion from trusted producers, including:

- A-Mark: An American company, established in 1965, with an international reputation for superior metal quality.

- Atlantis Mint: Specializes in hand-poured ingots with dragon, lion, and skull-and-crossbones designs.

- Geiger Edelmetalle: One of Germany’s oldest silver trading houses.

- Highland Mint: Produces a striking 10 oz silver bar with a horse imprint.

- Johnson Matthey: London-based company awarded multiple Queen’s Awards for innovation.

- Royal Canadian Mint: Produces Canadian currency and 100-oz silver bars.

- SilverTowne: Indiana-based company focused on high quality and low costs.

- Sunshine Mint: Idaho-based mint offering bullion with anti-fraud security images.

- MK Barz: A Southern California manufacturer producing limited edition handpoured ingots to large runs of press minted rounds. Skulls and colorized pop icon themes.

What Size Do We Purchase?

Different bar sizes have unique pricing structures and premiums. A 1-oz bar typically carries the highest premium, while 5-oz bars cost slightly less per ounce. The 10-oz bar is the most frequently sold, usually providing the lowest premium.

Poured Silver Selling Process

Selling hand-cast bullion follows a straightforward and transparent evaluation process designed to protect sellers and ensure fair market pricing. Once the silver piece is presented, specialists begin by confirming identifying marks, approximate weight, and general composition through visual inspection. Non-destructive testing methods are then used to verify metal content without altering the item. After authentication, live market pricing is applied to determine a competitive offer based on current conditions. Sellers are guided through each step, with clear explanations provided before any decision is made, creating a smooth and confidence-driven transaction from start to finish.

Liquidity of Cast Bullion in the U.S. Secondary Market

Cast bullion products are actively traded within the U.S. secondary metals market. Their appeal lies in simplicity — buyers and sellers understand that value is directly tied to metal content rather than visual condition or rarity.

This liquidity allows sellers to move assets efficiently without long waiting periods. Many dealers prefer these products because they are easy to authenticate and resell without additional processing.

Liquidity Advantages

- Strong demand from private investors

- Accepted by bullion dealers nationwide

- Easier resale than novelty or collectible pieces

- Pricing aligned closely with live market values

Because of this demand, sellers often experience fast evaluations and competitive offers.

The Pouring Process

Silver mining has been ongoing since the 17th century, but bar-pouring techniques developed in the 1800s. Molten silver, heated to 2,000 degrees Fahrenheit in a blazing orange-red crucible, is refined until smooth and free of impurities, then poured into graphite or stainless steel molds. Graphite molds are cheaper but last only 20–40 pours. Stainless steel molds are durable and preferred by professional mints.

After cooling, bars are removed from molds and washed in a pickling bath to eliminate residue, including smelting flux used in purification. The bars are polished and packaged for sale.

Weight Accuracy and Metal Content Expectations

Professional buyers place strong emphasis on weight accuracy and metal content when evaluating cast bullion. While hand-poured pieces may display slight dimensional differences, reputable producers adhere to strict weight tolerances to ensure consistency.

Most poured ingots sold in the U.S. meet or exceed the stated weight, providing sellers with confidence during resale. Any minor variance is typically addressed during evaluation and does not negatively impact legitimate pieces.

What Buyers Typically Confirm During Evaluation

- Metal fineness consistency

- Weight verification using calibrated scales

- Absence of non-silver fillers

- Proper marking or identifiable origin

These checks ensure fair pricing and maintain integrity throughout the transaction.

Shiny and New Versus Old and True

Some sellers favor poured silver bars that look shiny and new. Visual appeal is natural, but the condition does not affect the silver’s value. Qualified bullion bars are .999 pure, regardless of shine.

Secondhand bars, even with wear, are worth the same in spot as new bars. Sellers often receive competitive offers for these older or vintage style bars because appearance influences the sale price.

DEIGOLDANDSILVERCOINS purchases a wide range of poured silver bars from respected mints like SilverTowne, Johnson Matthey, and Engelhard. Browse our selection today and discover how much your silver is worth.

To sell your Poured Silver, contact our team via email or call + (702) 460-5188 to get a professional evaluation. We guide you through every step of the selling process for a smooth and reliable transaction.

Selling Single Pieces vs. Multiple Units

Sellers approach liquidation in different ways. Some bring in a single cast ingot, while others present multiple units acquired over time. Both scenarios are handled using the same professional evaluation standards.

Selling multiple pieces together may streamline the process and reduce per-item handling, which can be beneficial for estates or long-term investors exiting positions.

Benefits of Selling Multiple Units

- Faster overall evaluation

- Simplified transaction flow

- Consistent pricing methodology

- Secure handling throughout

Regardless of quantity, sellers receive clear explanations and transparent offers.

Why Hand-Poured Bullion Appeals to Long-Term Investors

Hand-poured bullion holds a unique position in the precious metals market because it combines intrinsic metal value with individuality. Unlike machine-stamped products, each poured ingot carries subtle differences in texture, edge formation, and surface flow. This natural variation appeals to investors who value authenticity and craftsmanship alongside metal content.

In the U.S. market, these cast ingots are commonly held as long-term assets due to their straightforward valuation and broad buyer acceptance. Investors often choose them as a hedge against inflation, currency fluctuation, and market volatility.

From a resale perspective, poured formats remain attractive because pricing is driven primarily by weight and purity rather than collectible premiums. This keeps transactions simple, transparent, and aligned with live market pricing.

Secure Handling Standards During Evaluation

Security is a critical factor when dealing with physical precious metals. Professional buyers follow established handling protocols to ensure that all items remain protected from the moment they are received until the transaction is completed.

Each evaluation takes place in a controlled environment using professional equipment. Items are documented, tested, and stored securely throughout the process.

What Sellers Can Expect

- Supervised inspection procedures

- Secure storage during evaluation

- Clear documentation of findings

- Prompt settlement once an offer is accepted

These practices reinforce trust and protect seller interests.

DEIGOLDANDSILVERCOINS Customer Reviews

At DEIGOLDANDSILVERCOINS, customer satisfaction is our highest priority. We welcome feedback and strive to improve our buying process every day. To learn more about our dedication, read our customer testimonials and see why sellers trust us with their precious metals.

Guidance for First-Time Bullion Sellers

Many individuals selling physical silver for the first time may feel uncertain about the process. Professional buyers recognize this and prioritize education and communication at every stage.

Sellers are encouraged to ask questions and gain clarity on how pricing is determined, how testing works, and what payment options are available. A clear understanding leads to smoother transactions and better outcomes.

Common Topics First-Time Sellers Ask About

- How metal value is calculated

- What testing methods are used

- How long evaluations take

- When payment is issued

Providing clear answers helps build confidence and long-term trust.

Buy or Sell Gold & Silver Coins with Confidence

Work with a trusted Las Vegas coin dealer offering fair pricing, honest appraisals, and expert guidance every step of the way.